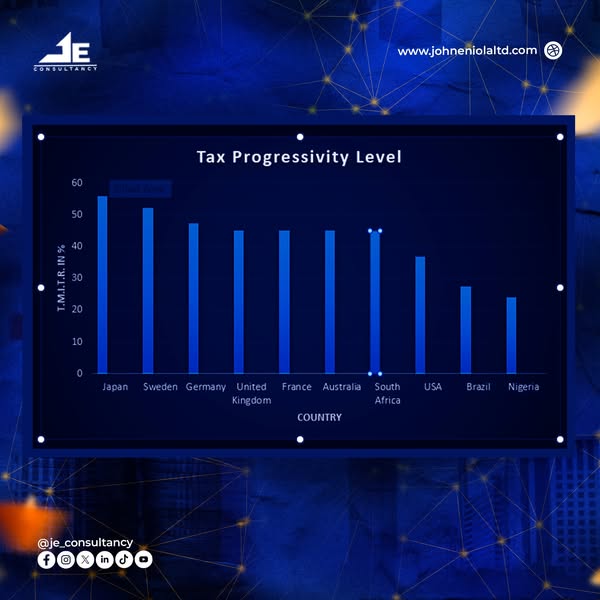

Progressive Tax Policies: Case Study

Lagos Land Use Charge What It Does:Combines three separate property taxes into one consolidated payment making compliance easier for residents. Progressivity Structure Importance or Benefits Why it Works: Due to clarity and its alignment with urban development strategies. Global Example:…