An interest rate is the percentage charged on a loan or earned on an investment over a specific period of time. It represents the cost of borrowing money or the return on funds invested.

Loan Interest

If one takes a loan with a 5% interest rate per annum, one will pay back the amount borrowed plus 5% of that amount calculated over the period of the loan, technically referred to as the tenor.

Investments or Savings Interest

If one puts money in a savings account or invests under some scheme with a 2% interest rate per annum, one will earn 2% of funds deposited or invested as interest, calculated over the period of the deposit or investment (tenor).

Types of Interest Rates

- Fixed Interest Rate

This rate remains constant throughout the life of the loan or investment. Borrowers or investors know exactly how much they will pay or earn in interest over the period.

Formula:I = P × r × t

Where:- I = Interest

- P = Principal (Amount invested, saved, or borrowed)

- r = Rate in %

- t = Tenor in years

- Variable/Floating Interest Rate

This rate can fluctuate over time based on changes in a benchmark interest rate or index.

Formula:Variable Interest = Benchmark Rate + Margin - Annual Percentage Rate (APR)

This rate includes not only the interest cost but also any other additional fees or costs associated with the loan, providing a comprehensive measure of the total cost of borrowing on an annual basis.

Formula:APR = (I + F / P) × (365 / T) × 100

Where:- I = Interest

- F = Fees

- P = Principal/Loan Amount

- T = Tenor/Time in days

- Annual Percentage Yield (APY)

This rate reflects the total interest earned on an investment or deposit over one year, taking into account the effects of compounding.

Formula:APY = (1 + r/n)^n - 1

Where:- r = Period rate

- n = Number of compounding periods

- Simple Interest Rate

This rate is calculated only on the principal amount of a loan or investment. It does not consider any previously accrued interest.

Formula:SI = P × r × t

Where:- SI = Simple Interest

- P = Principal

- r = Rate in %

- t = Tenor in years

- Compound Interest Rate

This calculates interest on both the initial principal and the accumulated interest from previous periods—leading to “interest on interest”.

Formula:CI = P(1 + r/n)^(nt) – P

Where:- CI = Compound Interest

- P = Principal

- r = Nominal annual interest rate

- n = Compounding frequency (1: annually, 12: monthly, 52: weekly, 365: daily)

- t = Time in years

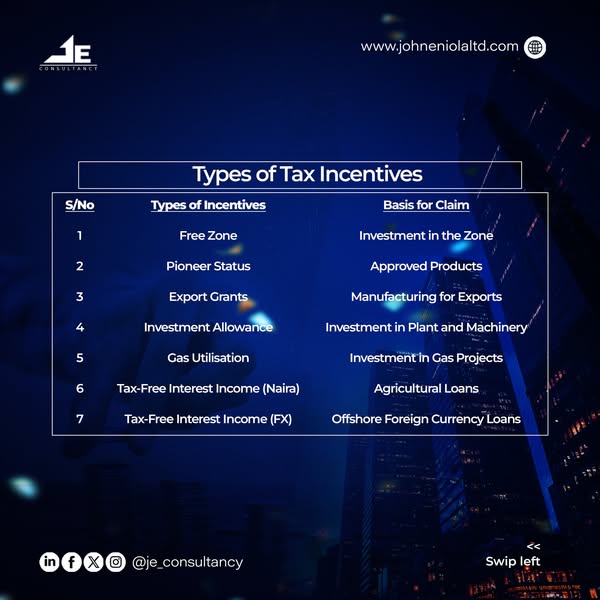

Definition / Meaning of Tax Incentive

A tax incentive is an aspect of a government’s taxation policy designed to incentivise or encourage a particular economic activity by reducing tax payments. Tax incentives can have both positive and negative impacts on an economy.

Tax incentives are financial benefits provided by governments to encourage specific behaviours or activities among individuals or businesses. These incentives can take various forms such as:

- Tax credits

- Deductions

- Exemptions

- Reduced tax rates

These are designed to stimulate investments, thereby promoting economic growth.

Vision and Aim of Tax Incentives

The aim or vision of tax incentives is to foster a vibrant and inclusive economy, thereby achieving social goals within targeted sectors or regions.

Money Market Indicators (In %)

Impact of High Interest Rates on Companies Under Tax Incentives

Focusing on the challenges posed by high interest rates and their effects on companies under tax incentives reveals several critical issues, some of which are:

- Increased Financing Costs

Companies relying on loans for expansion or operations face higher borrowing costs. This can diminish the impact of tax incentives, as the additional financial burden may outweigh the benefits of reduced taxes. - Reduced Investments in Growth

High interest rates can lead companies to postpone or scale down investments in:- New projects

- Technology

- Hiring

- Training of staff

Tax incentives aimed at promoting growth may not be fully utilized if firms are hesitant to take on costly debts.

- Erosion of Profit Margins

Increased financing costs can squeeze profit margins, particularly for companies operating in competitive markets. If these companies are unable to pass on costs to consumers, their financial viability may be jeopardized despite tax reliefs. - Cash Flow Strain

Companies with existing variable-rate debt may see their cash flow significantly impacted by rising interest payments. This can lead to more stringent/frugal budgets, affecting their ability to reinvest in the business—even when tax incentives are available. - Disincentive for Expansion

Tax incentives are often designed to encourage business expansion. However, when high interest rates make borrowing prohibitive, companies may decide against scaling up operations, thereby negating the purpose of such incentives. - Impact on Start-ups and SMEs

Smaller companies and start-ups, which often depend heavily on external financing, can be gravely affected by high interest rates. These businesses may struggle to leverage tax incentives due to their inability to secure affordable loans.

While tax incentives aim to stimulate investment and growth, the challenges associated with high interest rates can undermine their effectiveness—leading to:

- Reduced economic activity

- Limited benefits for businesses